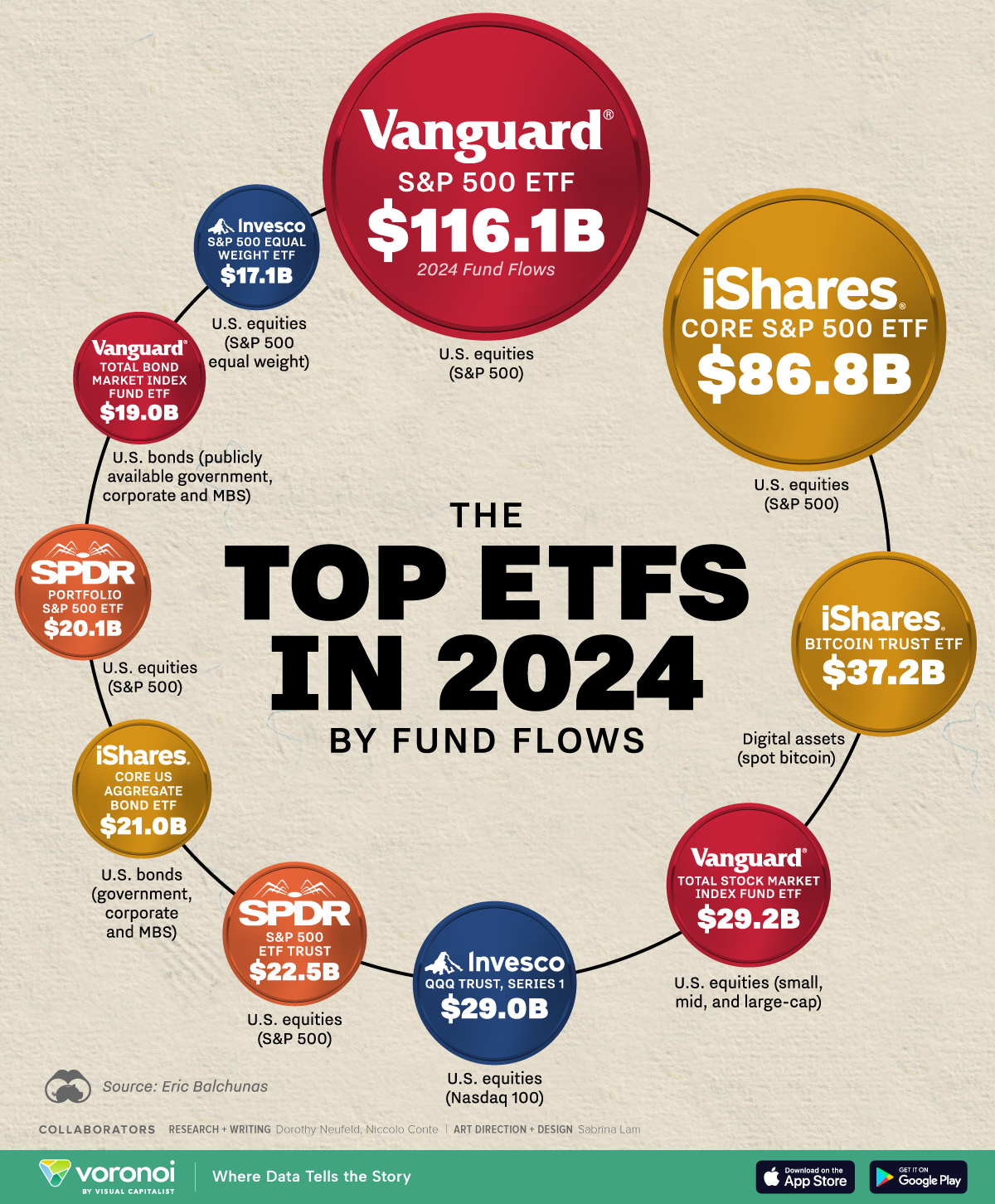

Ranked: The Top 10 ETFs in 2024 by Fund Flows

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Over 2024, investors poured $1.1 trillion into U.S. ETFs in a record-breaking year.

In typical fashion, the largest S&P 500 ETFs saw the highest inflows, while the iShares spot bitcoin ETF pulled in $37.2 billion, coming in third. Investor optimism surrounding big tech, the U.S. economy, and Trump’s election victory largely spurred inflows over the year as a number of asset classes achieved double-digit returns.

This graphic shows the top U.S. ETFs by fund flows in 2024, based on data from Eric Balchunas.

U.S. Equity Funds Dominate ETF Inflows

As the table below shows, the Vanguard S&P 500 ETF saw the highest inflows, surpassing its previous record by a stunning $65 billion:

| Rank | Name | Description | 2024 Fund Flows |

|---|---|---|---|

| 1 | Vanguard S&P 500 ETF | U.S. equities (S&P 500) | $116.1B |

| 2 | iShares Core S&P 500 ETF | U.S. equities (S&P 500) | $86.8B |

| 3 | iShares Bitcoin Trust ETF | Digital assets (spot bitcoin) | $37.2B |

| 4 | Vanguard Total Stock Market Index Fund ETF | U.S. equities (small, mid, and large-cap) | $29.2B |

| 5 | Invesco QQQ Trust, Series 1 | U.S. equities (Nasdaq 100) | $29B |

| 6 | SPDR S&P 500 ETF Trust | U.S. equities (S&P 500) | $22.5B |

| 7 | iShares Core US Aggregate Bond ETF | U.S. bonds (government, corporate and MBS) | $21B |

| 8 | SPDR Portfolio S&P 500 ETF | U.S. equities (S&P 500) | $20.1B |

| 9 | Vanguard Total Bond Market Index Fund ETF | U.S. bonds (publicly available government, corporate and MBS) | $19B |

| 10 | Invesco S&P 500 Equal Weight ETF | U.S. equities (S&P 500 equal weight) | $17.1B |

Next in line was the iShares Core S&P 500 ETF, pushing BlackRock’s shares to all-time highs in 2024.

Following regulatory approval earlier in the year, the iShares spot bitcoin ETF broke numerous records. Despite investors pulling substantial funds from the ETF in December due to lower demand from institutional investors, it maintained its spot in the top three.

Ranking in fifth was the Invesco QQQ ETF, seeing a threefold increase in fund flows compared to 2023. The ETF, which tracks the Nasdaq 100, has $325 billion in assets, making up nearly half of the firm’s overall U.S.-listed ETF assets under management.

Meanwhile, Invesco’s equal-weight S&P 500 ETF ranked among the top 10 ETFs, illustrating demand from more cautious investors in a market concentrated heavily in megacap companies. Overall, five of the top ETFs tracked the S&P 500 as the index soared 23.3%.

As we can see, the majority of ETFs seeing the greatest inflows were equity ETFs, however, up until November, bond ETFs rose at a faster rate as investors sought to lock-in higher yields ahead of interest rate cuts. Yet in November, net ETF inflows surged to a monthly record of $164 billion, focused largely on equity and bitcoin ETFs after Trump’s election victory.

Learn More on the Voronoi App

To learn more about this topic from a sector-based perspective, check out this graphic on the largest ETFs across 11 major stock sectors.