The Best S&P 500 Sectors During Trump and Biden’s Terms

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The S&P 500 has nearly erased its post-election gains, as inflation fears weigh on market optimism surrounding Trump’s proposed tax cuts and deregulation. But what impact can we expect from the incoming administration’s policies on the markets?

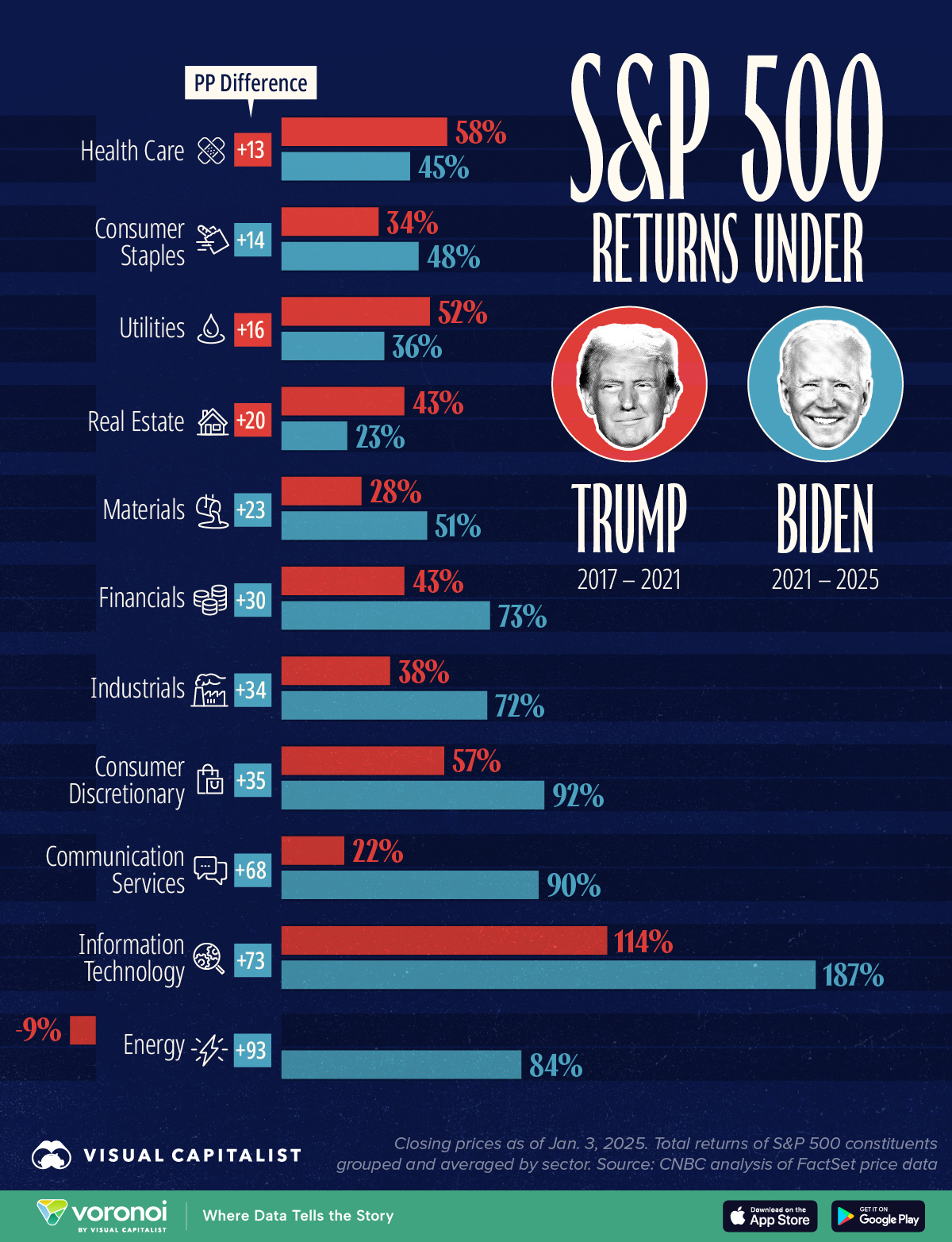

To assist in this analysis, the following graphic compares the performance of various sectors during the Trump (2017–2021) and Biden (2021–2025) presidencies. The data, based on a CNBC analysis of FactSet price information, uses closing prices as of January 3, 2025.

Data and Key Highlights:

Below is the data used in the visualization, highlighting S&P 500 sector results during both recent presidential terms:

| Sector | Trump | Biden |

|---|---|---|

| Energy | -9% | 84% |

| Information Technology | 114% | 187% |

| Communication Services | 22% | 90% |

| Consumer Discretionary | 57% | 92% |

| Industrials | 38% | 72% |

| Financials | 43% | 73% |

| Materials | 28% | 51% |

| Real Estate | 43% | 23% |

| Utilities | 52% | 36% |

| Consumer Staples | 34% | 48% |

| Health Care | 58% | 45% |

- Information Technology Dominates: The IT sector was the best performer during both administrations, fueled by the continued growth of major tech companies.

- Energy’s Surprising Rise Under Biden: Despite Biden’s green agenda, the Energy sector emerged as a top performer during his term. In contrast, energy stocks stagnated during Trump’s presidency.

- Sector Laggards: Communication services had the poorest performance under Trump, while the Real Estate sector delivered the worst returns under Biden.

Experts consulted by CNBC suggest that over the long term, stock movements are less influenced by presidential policies or Congressional actions. Instead, they are primarily driven by fundamentals such as corporate earnings, debt levels, inflation, and interest rates.

Learn More on the Voronoi App

If you enjoyed this topic, check out this graphic showing the number of acres leased on public lands to oil and gas companies during the Obama, Trump and Biden administrations.